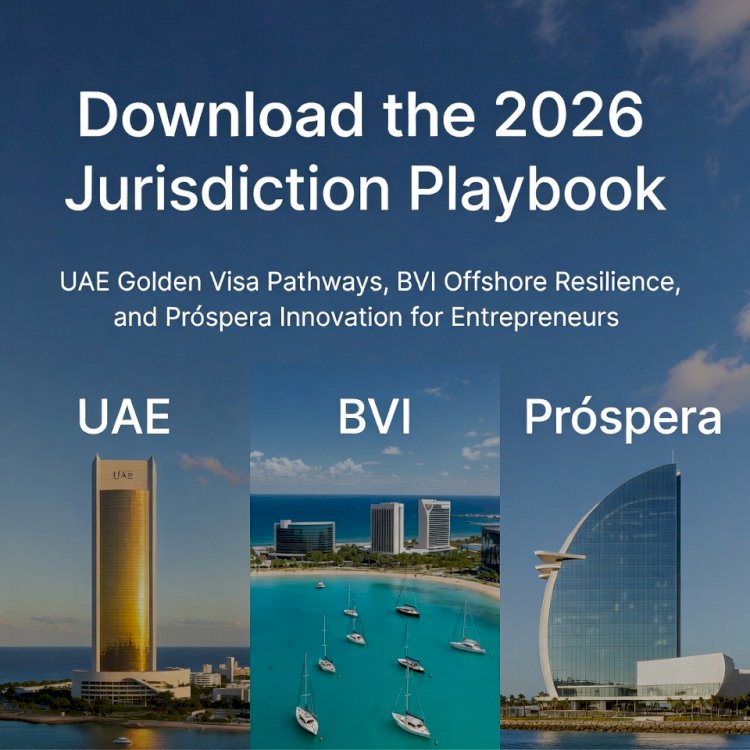

Download the 2026 Jurisdiction Playbook – UAE Golden Visa Pathways, BVI Offshore Resilience, and Próspera Innovation for Entrepreneurs

In a world where jurisdictional strategy defines wealth preservation and business freedom, a new authoritative ebook provides entrepreneurs and investors with the definitive roadmap for 2026.

Download this E-Book Directly

Get the E-Book from Google Books

Jurisdiction Alchemy: Mastering UAE, BVI, and Próspera for Tax-Free Residency and Global Wealth in 2026 offers in-depth, actionable guidance across three powerhouse jurisdictions. The UAE stands out for its evolving Golden Visa options through company formation—qualifying investors can secure long-term residency (up to 10 years) via business setups with minimum capital thresholds like AED 2 million in qualifying investments or tax contributions of AED 250,000 annually, combined with near-zero effective corporate tax in free zones and streamlined remote formation processes.

The British Virgin Islands remains the gold standard for offshore structuring, with its tax-neutral framework (zero corporate, income, or capital gains tax on offshore activities), English common-law principles, and ongoing compliance adaptations—including economic substance filings now transitioning to the VIRRGIN portal for 2026 reports, ensuring robust asset protection, corporate mobility, and family office holdings amid global transparency standards.

Rounding out the guide, Próspera on Roatán, Honduras, continues as a bold experiment in voluntary governance and digital innovation—hosting events like Infinite Games in early 2026, offering lump-sum tax programs (e.g., $5,000 annual flat tax for eligible residents), and attracting crypto builders, longevity enthusiasts, and borderless startups despite ongoing legal debates over ZEDE autonomy.

Authored by a cross-border structuring specialist, the book delivers practical steps, compliance updates, tax efficiency tactics, and strategic insights to build resilient, optimized structures in an unpredictable global landscape.

content-team

content-team