How Centralized Is Bitcoin?

Given the information below, it can be seen that in fact this network is not decentralized and many of its nodes are concentrated in a few countries.

One of the most important reasons behind developing a cryptocurrency called Bitcoin was so that money concentration would not be held by a government or organization, and also to create a decentralized network for money generation and transfer. As a result, no certain organization will be in charge of money and able to generate as much of it as it wants, also, money transfer cannot be stopped by anyone. In this article, we want to investigate how decentralized Bitcoin actually is and whether its promises have been realized or not; because the existence of centralized infrastructures in this network could incur irrecoverable damages such that it will no longer be an ideal cryptocurrency for money transfer and storage. To conduct this investigation, Bitcoin nodes, miners, the number of Bitcoin wallets, and value distribution (whales) will be reviewed.

Node Distribution

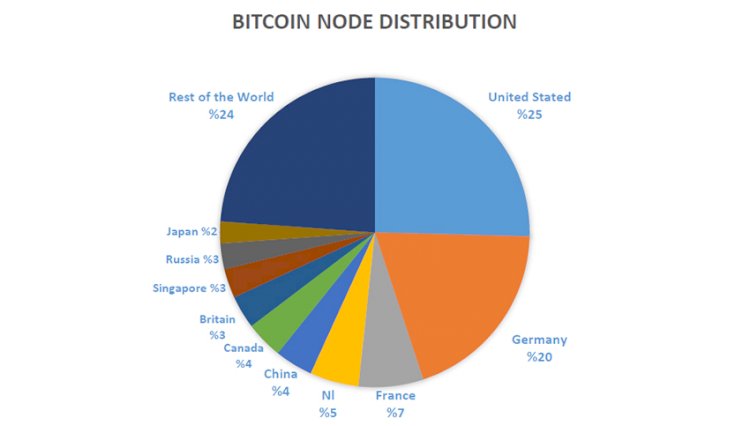

Nodes are in charge of transferring messages in the Bitcoin network. Messages in the Bitcoin network are like singed transactions and if there is issue in the nodes, then the Bitcoin network cannot be used for transfers. Given the information below, it can be seen that in fact this network is not decentralized and many of its nodes are concentrated in a few countries. As a result, if there is a judicial mandate in one of these countries, the outgoing transactions from a certain country can be censored.

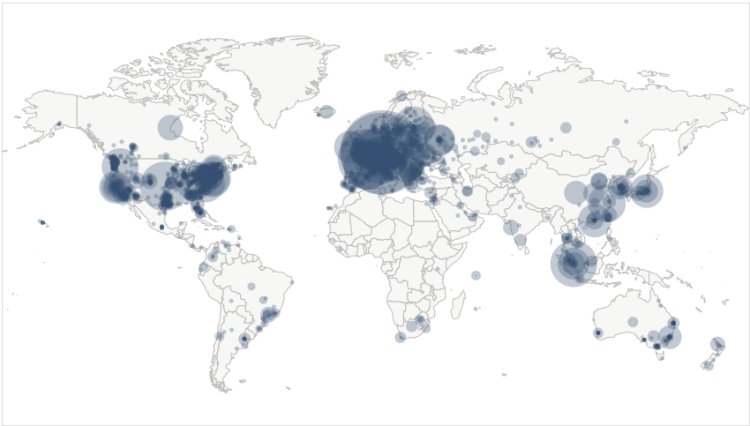

Bitcoin network’s node distribution map:

Geographical distribution of the nodes in the Bitcoin network:

|

Rows |

Country |

Number of Nodes |

Percentage out of total nodes |

|

1 |

United States |

2625 |

25.4 |

|

2 |

Germany |

2016 |

19.5 |

|

3 |

France |

698 |

6.7 |

|

4 |

Netherlands |

527 |

5.1 |

|

5 |

China |

411 |

3.9 |

|

6 |

Canada |

402 |

3.8 |

|

7 |

Britain |

357 |

3.4 |

|

8 |

Singapore |

316 |

3 |

|

9 |

Russia |

276 |

2.6 |

|

10 |

Japan |

236 |

2.2 |

As a result, the first three countries have 50 percent of the nodes, and the first 10 countries have 75 percent of all the nodes in the Bitcoin network.

Distribution of Miners

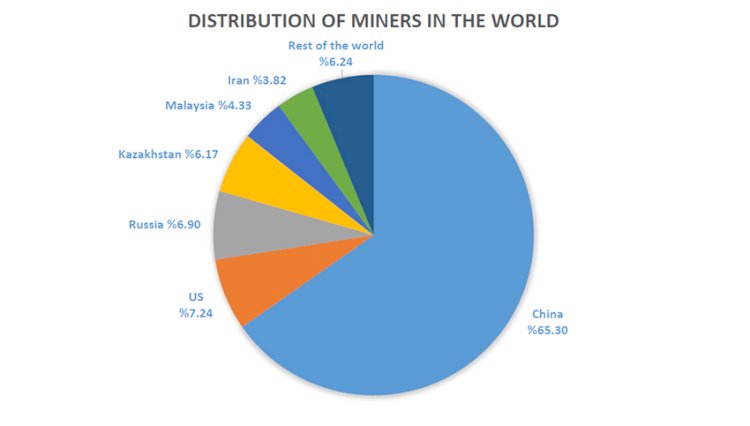

Now, we will investigate the lack of distribution among miners. This matter can be investigated on two levels; hash rate of miners (number of miners) and mining pools. First, we will review the number of miners in different countries.

The concentration of miners in a country will able the government of that country to have a surveillance tool over the Bitcoin network and be able to affect this network. In the chart below, you can see the distribution of miners in different countries. According to this chart, you can see that the first six countries are responsible for more than 93 percent of mining in this network. Additionally, the high concentration of miners in China pose a serious issue, since the decisions made by this country can impact Bitcoin.

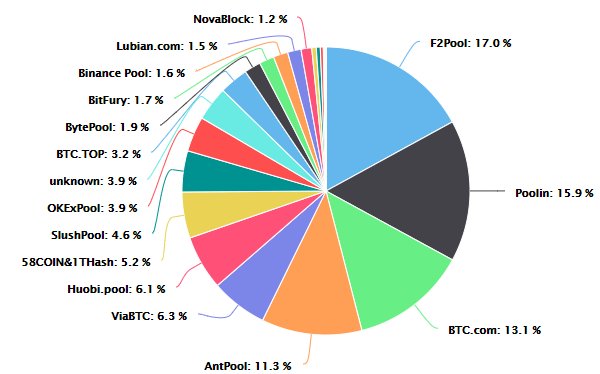

Mining Pool Distribution

Mining pools are where new Bitcoin blocks are created. Miners from all over the world are connected to these pools and help generate Bitcoin. Almost all big pools are located in China, and based on the chart below, it can be seen that the four biggest mining pools hold about 57 percent of the entire Bitcoin network.

This concentration could yield two potential threats. One is that the government of China could take over the entire Bitcoin network, and the other threat is that the four biggest pools could collaborate and make any changes in the Bitcoin network. If someone is in control of more than 50 percent of the network, something that is known as the 51 percent attack, then they could make any changes to the network and control it. Given the conditions, these four pools can simply collaborate and take over the entire network and alter it in any way. This means that the Bitcoin network is only a collaboration between 4 parties away from a 51 percent attack!

Value Distribution

When it comes to the distribution of Bitcoin itself, the people of US, Romania, Czech Republic, China, Spain, Poland, Turkey, Japan, Switzerland, and South Korea have the most amount of Bitcoin. Those who store a great amount of Bitcoin are referred to as Bitcoin whales, and these whales can affect the prices in the market and change them in their own favor. One of the worst things that these whales do is to pump and dump the price. Simply put, pump and dump means increasing the prices artificially and then after traders are attracted to the market, whales would rush in and sell the coins with a high price and then leave. This will result in serious loss to all buyers and serious benefit for the whales.

By reviewing the Bitcoin addresses and the amount of Bitcoin they hold, we can get to some interesting results.

|

Amount of Bitcoin |

Number of Addresses |

Percentage of Addresses |

Entire Bitcoin in Addresses |

Percentage of Bitcoin out of All Available Bitcoin |

|

(0 - 0.001) |

15231095 |

48.66% |

2,996 |

0.02% |

|

[0.001 - 0.01) |

7585797 |

24.24% |

30,707 |

0.17% |

|

[0.01 - 0.1) |

5367010 |

17.15% |

173,651 |

0.94% |

|

[0.1 - 1) |

2295233 |

7.33% |

724,732 |

3.92% |

|

[1 - 10) |

666683 |

2.13% |

1,731,410 |

9.37% |

|

[10 - 100) |

137586 |

0.44% |

4,450,163 |

24.09% |

|

[100 - 1,000) |

13854 |

0.04% |

3,476,495 |

18.82% |

|

[1,000 - 10,000) |

2091 |

0.01% |

5,212,095 |

28.22% |

|

[10,000 - 100,000) |

103 |

0% |

2,421,617 |

13.11% |

|

[100,000 - 1,000,000) |

1 |

0% |

247,502 |

1.34% |

This table shows that for example %0.01 of Bitcoin holders (2195 out of 31,299,453 addresses) have more than the 42 percent of the available Bitcoin, and %0.05 of Bitcoin holders (16,049 out of 31,299,453 addresses) have more than 61 percent of all Bitcoins! On the other hand, %72 of Bitcoin holders (22,816,892 out of 31,299,453 addresses) have less than 2 percent of Bitcoins altogether. These numbers indicate that the most amount of Bitcoins are held by a very small minority and most people are working with a very small percentage of Bitcoins in the market. In other words, it can be said that class disparity in off the charts in the Bitcoin world!

As it was seen, when it comes to Bitcoin nodes, miners, the number of Bitcoin wallets, and value distribution (whales), Bitcoin is not at all decentralized and has not been able to realize its promises. May a new solution be found for this issue.

References:

cintjournal admin

cintjournal admin