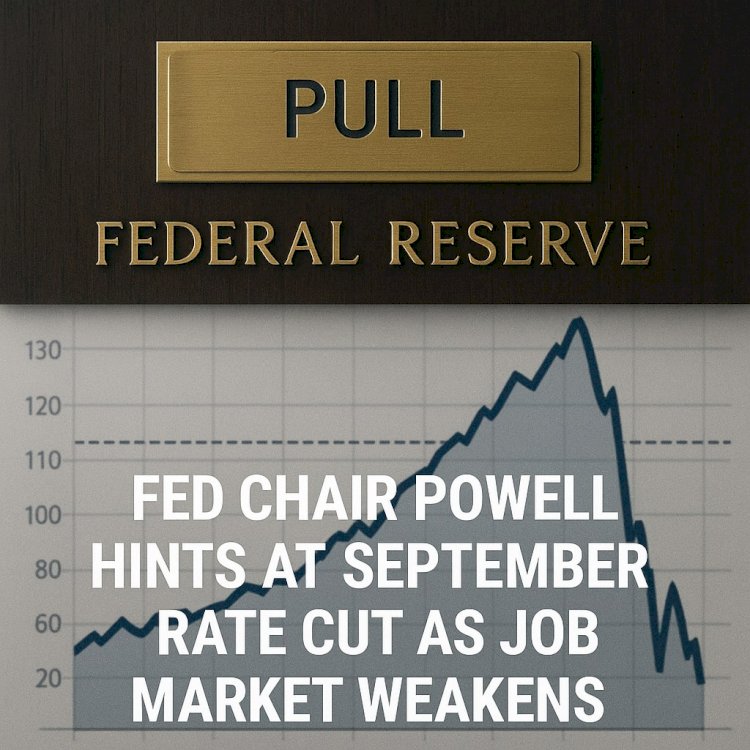

Fed Chair Powell Hints at September Rate Cut as Job Market Weakens

August 25, 2025 — Federal Reserve Chair Jerome Powell has signaled that the central bank may move toward lowering interest rates as soon as September, reflecting growing concerns over a cooling labor market and lingering tariff-related inflation.

A Shift in Priorities

Powell, speaking at the annual Jackson Hole economic symposium, highlighted that the Fed’s primary concern is increasingly tilting toward employment risks. He noted that both hiring and labor participation have begun to soften, raising fears of unexpected job losses if policy remains too restrictive.

Markets React Swiftly

Investors responded with enthusiasm. Stock markets surged, bond yields retreated, and the dollar weakened as traders bet on a near-certain quarter-point cut next month. Futures markets now suggest a strong probability of additional easing before the end of the year.

Debate Inside the Fed

While Powell’s remarks opened the door to rate reductions, other policymakers remain cautious. Some regional Fed presidents have warned that inflation—still influenced by tariff-driven price pressures—could complicate any move toward easing. The split underscores how closely the Fed will scrutinize upcoming economic data.

The Road Ahead

Two critical indicators will likely determine the Fed’s course at its September 16–17 meeting:

-

New labor market reports that could confirm a slowdown in hiring.

-

Updated inflation data, particularly the core PCE index, which remains the Fed’s preferred measure.

For now, Powell’s signal marks a potential turning point. After a prolonged period of high interest rates aimed at curbing inflation, the Fed appears prepared to pivot—provided the data confirm the economy is cooling faster than expected.

content-team

content-team